- The Skinny on Wall Street

- Posts

- The Skinny On...

The Skinny On...

Meme Stocks | Cap Gains

This Week on The Floor

The “flight to crap” trade and DORK stocks: everything you need to know about the latest meme stock mania

More tax cuts on the horizon from the Trump administration? We break down the proposal to eliminate capital gains on real estate

Markets Recap / Deal News

Interviewing this week? Here’s some content for your conversation.

The “Flight to Crap” Trade: Meme Stocks 2.0

Meme stock mania is back.

Bloomberg ran a spotlight article on the surge in speculative activity in unexpected names, like real estate i-buyer Opendoor Technologies, department-store chain Kohls, and fast food restaurant chain Krispy Kreme. The new nickname for this group of stocks? “DORK”...which stands for DNUT, OPEN, RKT, and KSS.

These stocks have seen massive gains in July, fueled not by strong fundamentals, but rather by waves of coordinated retail buyers. In the words of Steve Sosnick, Chief Strategist at Interactive Brokers, the “flight to crap trade” is back.

Is the history of meme stock runups from 2020-2022 repeating itself?

Remember, the phenomenon of the meme stock runup is not simply retail investors buying languishing names in a vacuum. It’s also one in which buyers specifically target companies with high open short interest. Retail buyers (who rarely, though not always, take outright short positions) are looking to force hedge funds and other institutional investors who have borrowed shares of equity and sold them, looking to profit from a decline in the price, into what is called a “short squeeze”.

Take Opendoor, a tech-driven real estate flipper that went public via a SPAC led by “All-In” podcast host Chamath Palihapitya back in 2020. Its stock price is up nearly 500% this month following a chain of events that actually started during the first meme stock wave.

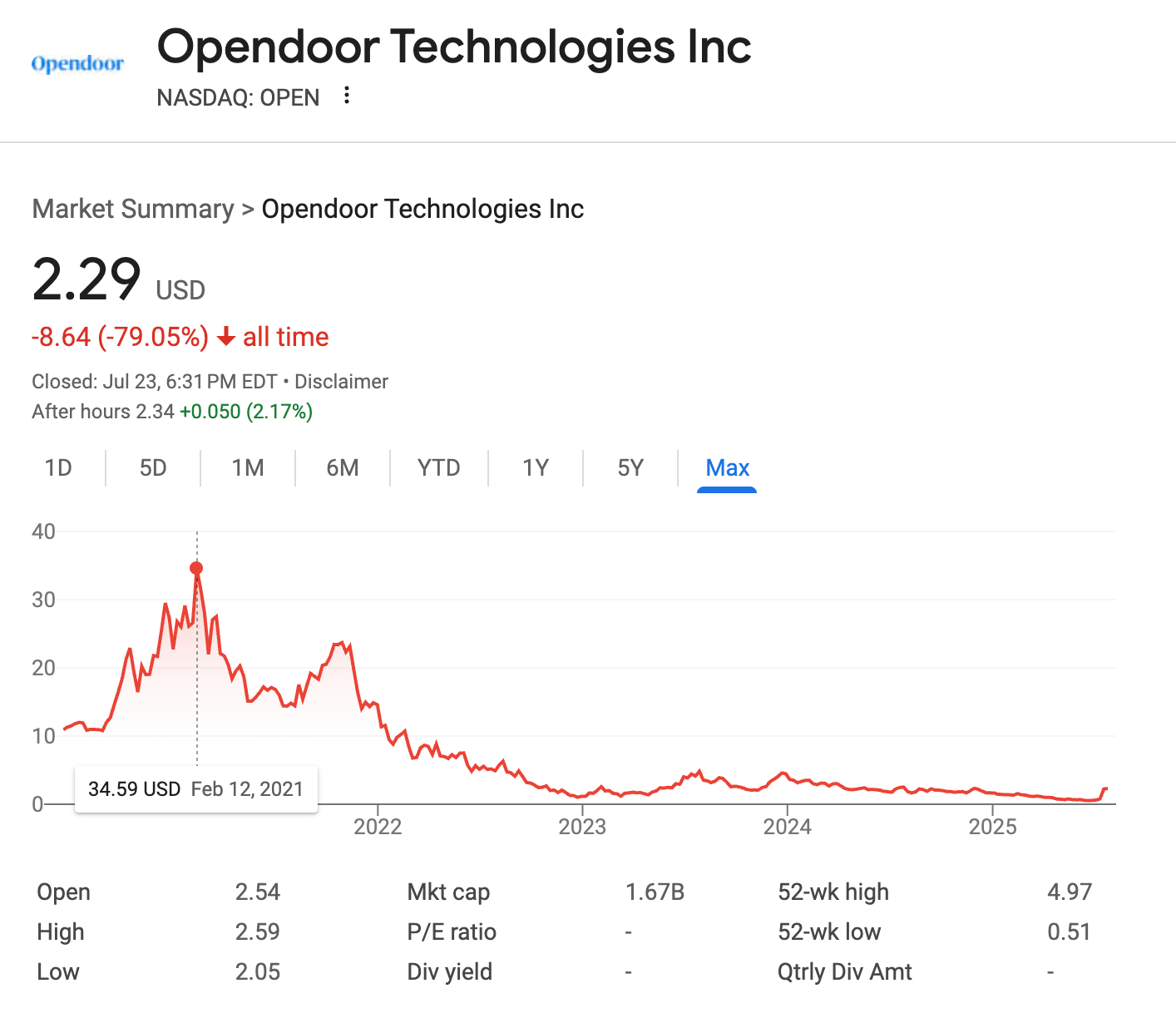

Before we get further into the business, remember: a SPAC is where you IPO a blank check company…and then this company that does NOTHING buys a real business, thereby taking it public. Most SPACs go public at an IPO price of $10. So when this company was a “blank check” company — really, just a pile of cash — it traded at $10. It traded up to $35 in February 2021, two months after the merger was completed. The current share price after the latest runup? $2.29, versus $10 when it was nothing more than a pile of cash.

That tiny little bump on the far right is what we’re all excited about…

Opendoor runs a business model of buying homes from owners who are either unwilling or unable to complete the repairs and updates necessary to maximize a home’s value when listing it for sale. They buy those homes well below market value, make the bare minimum updates, and then relist those homes for sale (with minimal representations) to the next buyer at an inflated value.

In the zero interest rate environment of COVID, when buyers were clamoring for any and all real estate they could get their hands on, investors were optimistic about Opendoor’s ability to turn a profit. Any real estate agent with boots on the ground could have told you otherwise. Even under the best of circumstances, house-flipping is a specialized business that requires deep knowledge of hyperlocal markets, relationships with skilled tradespeople, and rarely involves a “one size fits all” approach to improving challenging properties. In a high interest rate environment with picky buyers and changing market dynamics (see next article below), it’s a carry-intensive nightmare.

By June of this year, the stock was trading in the $0.50 range, with approximately 25% of its float having been sold short. Desperate to get its stock price back above $1 in order to stay listed on the NASDAQ, the company announced it was considering a reverse stock split. This prompted some positive price action. Then, hedge fund manager Eric Jackson took to Twitter and announced that his firm, EMJ Capital, had taken a position in Opendoor. He called it a “potential 100-bagger”, meaning that an investor could possibly hope to 100x their investment, turning every $1 invested in the name into $100.

The devotees of WallStreetBets on Reddit took up the thread, and the stock went on a tear, peaking around $3.21/share on Monday.

Targeting names with large short bases can lead to asymmetric short term price action to the upside for retail traders. Kohl’s had a short base of nearly 50% of its outstanding shares before almost doubling its stock price over the course of the past month.

But this pattern isn’t new. The original meme stock boom of 2021, which included names like GameStop, AMC, and Bed Bath & Beyond, also began with short squeezes. While those stocks delivered enormous short-term returns, their longer-term performance has been dismal. GameStop, for instance, soared from under $20 to nearly $500 in early 2021, only to crash below $20 within two years. AMC followed a similar path, and Bed Bath & Beyond eventually filed for bankruptcy. Most early retail traders who didn’t cash out during the peak ended up holding steep losses, underscoring the high-risk, high-volatility nature of these trades.

Despite the cautionary history, retail traders seem unfazed. Positive seasonals (July tends to have strong tailwinds for the markets overall) and the TACO euphoria from the first half of 2025 has traders feeling emboldened. And with social media amplifying sentiment, options markets offering cheap leverage, and a wide range of retail trading platforms making it easier than ever to access the markets, meme stock cycles are likely to persist — even if they remain detached from economic reality.

From Internship to Full Time Offer

When I was a summer intern, I remember the introductory training session was like drinking through a firehose. Trying to figure out how to apply those concepts on the desk was confusing, and I struggled to make the connections.

If you’re like me and want a companion resource that you can learn from on your own time, that will stick with you through your internship, your full time recruiting, and your early months on the desk, we’ve got you covered.

Our best in class self-paced Investment Banking and Private Equity Fundamentals course is available for those of you who want to make sure you not only get the offer, but also rank at the top of your class once you’re on the desk.

Un-”Cap”ping the Real Estate Market

Is removing the capital gains tax on real estate necessary…or even wise?

On Tuesday, President Trump signaled support for a potentially massive shift in U.S. housing tax policy. He told reporters he is considering backing Rep. Marjorie Taylor Greene’s bill that proposes eliminating federal capital gains taxes altogether on the sale of primary residences.

Why?

According to Greene, the purpose of the bill is to eliminate the so-called “stay put penalty”. Currently, homeowners benefit from a $250,000 exclusion ($500,000 for joint filers) on capital gains derived from the sale of a primary residence occupied for a minimum of two of the past five years. This number has remained unchanged since Section 121 of the tax code was enacted in 1997.

In 1997, the median home sold in America traded for approximately $145,000. As of January 2025, that number is around $417,000. So while the median home price has nearly quadrupled, the tax exemption remains unchanged from 30 years prior.

These numbers also fail to capture the extreme upside of the higher end of the real estate market, especially in areas that have seen massive relocation in recent years, like Greene’s state of Georgia in the Southeast. According to a study conducted by the National Association of Realtors (NAR), 34% of homeowners (~29mm Americans) would exceed the $250k threshold if they were to sell their homes. Some 10% (~8mm Americans) would surpass the $500k threshold for joint filers.

In a statement announcing her proposed “No Tax on Home Sales Act”, which would eliminate capital gains taxes on the sale of a primary residence altogether, Greene says “homeowners who have lived in their homes for decades, especially seniors in places where values have surged, shouldn’t be forced to stay put because of an IRS penalty…my bill unlocks that equity, helps fix the housing shortage, and supports long-term financial security for American families”.

Trump, in his conversation with reporters at the White House, suggested the proposal would have a similar effect as lowering interest rates, something he’s been calling for since his inauguration: “if the Fed would lower the rates, we wouldn’t even have to do that. But we are thinking about no tax on capital gains on houses.”

The theory here is that older, wealthier homeowners are more likely to downsize or relocate if the tax burden associated with the move is reduced, unlocking more equity in their homes without penalty. Proponents say this would ease inventory and affordability concerns in overheated markets with low supply.

Critics, however, contend that the policy would disproportionately benefit wealthier homeowners and reduce Federal tax revenues. Remember, the goal of any tax policy is usually twofold: raise government revenue and influence individuals’ behavior. For example, we previously had tax benefits for investing in clean energy that were eliminated in the BBB since it’s not a priority of the administration. Historically, the reason we had some of these real estate tax incentives — like deductions on mortgages and capital gains exemptions (both up to a certain threshold) — is because we wanted people to build wealth through homeownership. Today, while we still want young people to build wealth, the reality is that homeownership is unaffordable for many first time homebuyers. Perhaps instead of providing tax incentives for those who already own homes, new incentives need to be structured to foster wealth creation for the next generation.

It also seems unlikely that such a move would be politically palatable so soon after passing the Big Beautiful Bill. And to be clear: the exemption only applies to primary residences. It would do little to solve the issue of lower price point homes currently in the hands of investors and corporate owners, which arguably put greater constraints on inventory than primary residences.

But there are also headwinds within the housing market already that call into question the need for legislative solutions to inventory shortfalls.

Recent data shows that inventory is growing while sales are slowing. Last month, existing home sales dropped 2.7% from May to a nine-month low of 3.93mm (annualized). Homes are sitting on the market longer, averaging 27 days on market in June, up from 22 a year earlier. Meanwhile, inventory rose nearly 16% y-o-y to 1.53mm homes — approximately a 4.7 month supply. Typically a 4-6 month supply indicates a balanced market (<4 months being a seller’s market and >6 months being a buyer’s market). And contract failures are rising, with nearly one in seven pending contracts falling apart in June, the highest rate since records began in 2017.

What’s driving these shifts? Persistently high mortgage rates hovering around 7% and record-high home prices across much of the country certainly don’t help. But broader macro conditions, economic uncertainty, and inflation across other parts of the consumer spending wallet all mean Americans are willing and able to spend less on housing than they were in prior years. The changing climate in the housing market begs the question of whether we’re seeing the early phases of an organic correction that will eventually flow through to home prices down the line.

Even if Greene’s proposal has legs, these macro factors could blunt its impact. Freed equity may let some “trapped” homeowners trade up or downsize, but the combination of high financing costs, price pressure, and buyer hesitation could offset any resulting boost in inventory.

Put simply: does America even need this kind of policy, or would it just be a “nice to have” for a select set of wealthy homeowners?